A chartbook from

April 2017

Americans Want Payday

Loan Reform, Support

Lower-Cost Bank Loans

Results of a nationally representative survey of U.S. adults

The Pew Charitable Trusts

Susan K. Urahn, executive vice president

Travis Plunkett, senior director

Team members

Nick Bourke, director

Alex Horowitz, senior ocer

Olga Karpekina, associate

Gabe Kravitz, senior associate

Tara Roche, associate manager

Acknowledgments

The project team thanks Steven Abbott, Esther Berg, Jennifer V. Doctors, David Merchant, Liz Visser, Mark Wol,

and Cliord Zukin for providing valuable feedback on the report, and Molly Mathews for project management and

web support. Many thanks to our other former and current colleagues who made this work possible.

1

Overview

Typical payday loans have unaordable payments, unreasonable durations, and unnecessarily high costs: They carry

annual percentage rates (APRs) of 300 to 500 percent and are due on the borrower’s next payday (roughly two weeks

later) in lump-sum payments that consume about a third of the average customer’s paycheck, making them dicult

to repay without borrowing again.

In June 2016, the Consumer Financial Protection Bureau (CFPB) proposed a rule to govern payday and auto title loans

1

that would establish a process for determining applicants’ ability to repay a loan but would not limit loan size, payment

amount, cost, or other terms. The CFPB solicited and is reviewing public comments on whether to include in its final rule

alternatives to this process with stronger safeguards, particularly a “5 percent payment option” that would limit installment

payments to 5 percent of monthly income, enabling banks and credit unions to issue loans at prices six times lower than

those of payday lenders at scale. As such, it would be likely to win over many payday loan customers.

2

An analysis by The Pew Charitable Trusts determined that the CFPB’s proposal would accelerate a shift from lump-sum

to installment lending but, without the 5 percent option, would shut banks and credit unions out of the market, missing an

opportunity to save consumers billions of dollars a year.

3

To gauge public opinion on various reforms, including the proposed rule, Pew surveyed 1,205 American adults and found:

• 70 percent of respondents want more regulation of payday loans.

• 7 in 10 adults want banks to oer small loans to consumers with low credit scores, and the same proportion would view

a bank more favorably if it oered a $400, three-month loan for a $60 fee (as reportedly planned).

• When evaluating a loan regulation’s eectiveness, Americans focus on pricing rather than origination processes.

• Respondents say typical prices for payday installment loans that would probably be issued under the proposed rule

are unfair.

• 80 percent dislike the proposal’s likely outcome of 400 percent APR payday installment loans with more time to repay,

but 86 percent say enabling banks and credit unions to oer lower-cost loans would be a success.

These results show that the public supports the CFPB’s actions but strongly favors allowing banks and credit unions to

oer lower-cost loans. A separate Pew survey of payday loan borrowers found similar sentiments.

4

This chartbook

delves more deeply into these findings and discusses recommended changes to the proposal, including adoption of the

5 percent payment option, which is supported by Pew as well as many banks, community groups, and credit unions.

2

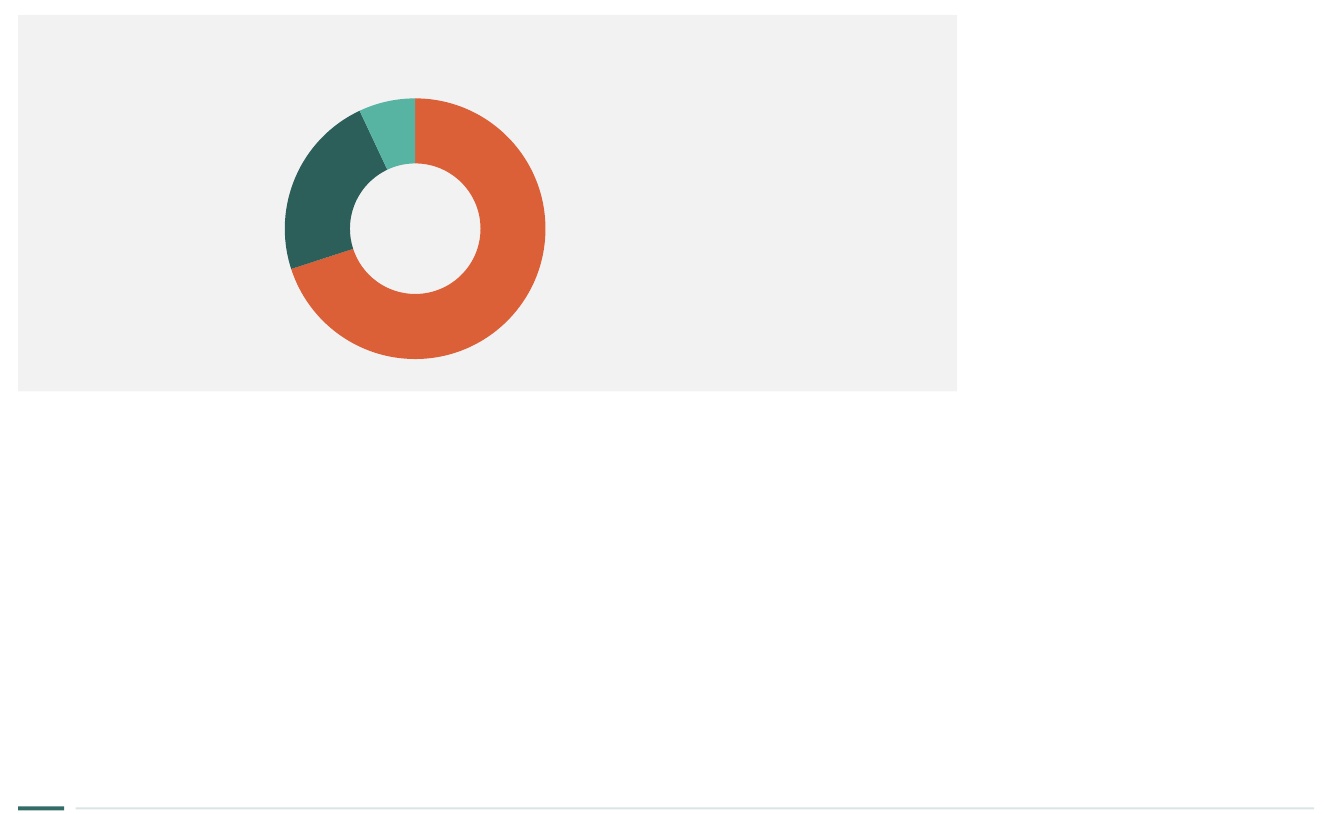

70

%

More

regulated

17

%

Not more

regulated

12

%

Don’t know/

refused

70

%

More

regulated

29

%

Not more

regulated

1

%

Refused to

answer

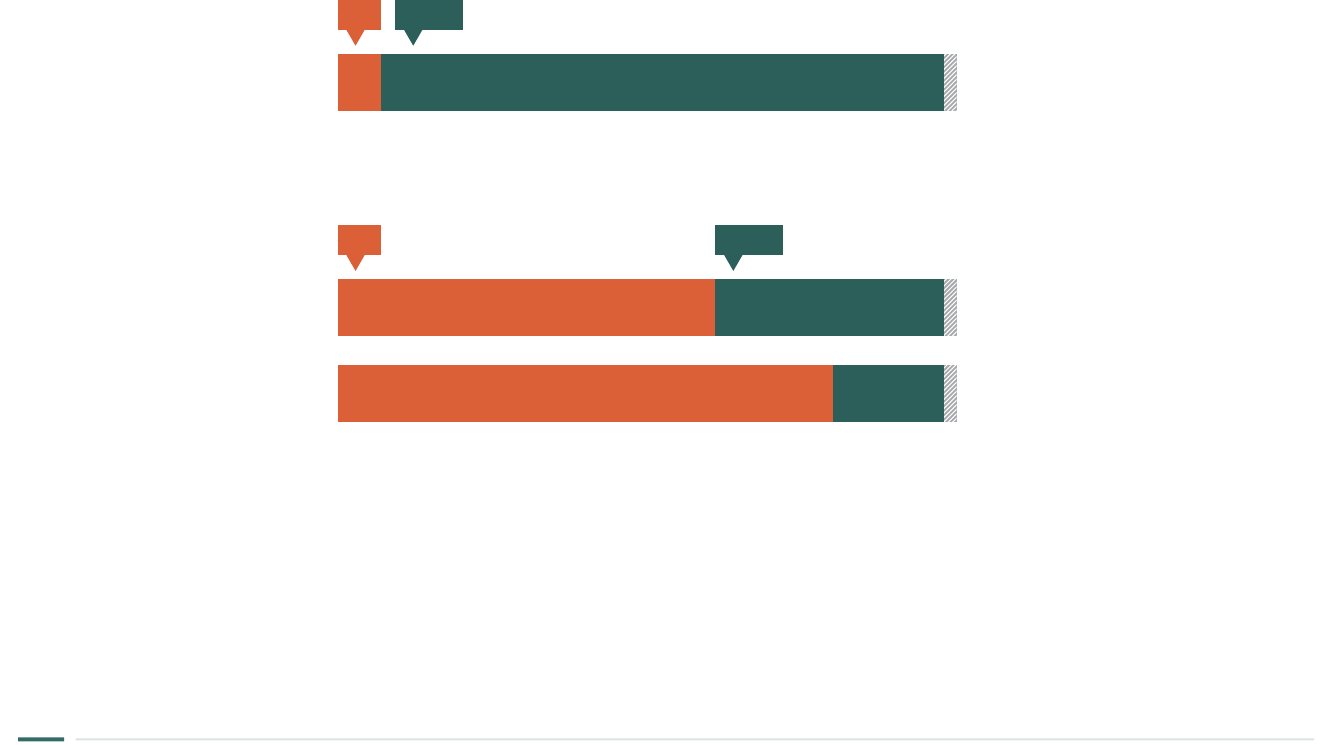

Figure 1

7 in 10 Americans, Borrowers Want Payday Loans to Be

More Regulated

Percentage of respondents, by survey group

Notes: Respondents were read the following statement: “Now I’d like to ask you some questions about payday lending. Payday lenders are

companies that generally operate through storefronts or the internet. They make small loans, often at high interest rates that are usually due

back on the borrower’s next payday.” Then they were asked: “Which of these statements comes closer to your point of view? 1) Payday loans

should be more regulated; 2) Payday loans should not be more regulated.” Results are based on 1,205 interviews. General population numbers

do not total 100 percent due to rounding. The payday borrower data are from a separate survey of payday loan borrowers that was conducted

online, and “don’t know” was not presented as an option, though respondents could decline to answer.

Source: The Pew Charitable Trusts, “Payday Loan Customers Want More Protections, Access to Lower-Cost Credit From Banks” (2017), www.

pewtrusts.org/en/research-and-analysis/issue-briefs/2017/04/payday-loan-customers-want-more-protections-access-to-lower-cost-credit-

from-banks

© 2017 The Pew Charitable Trusts

Roughly 12 million Americans

use payday loans annually,

spending an average of $520

on fees to repeatedly borrow

$375.

5

Borrowers and the general

population support more

regulation of the small-loan

industry in equal proportions.

70

%

More

regulated

17

%

Not more

regulated

12

%

Don’t know/

refused

70

%

More

regulated

29

%

Not more

regulated

1

%

Refused to

answer

General population Payday borrowers

3

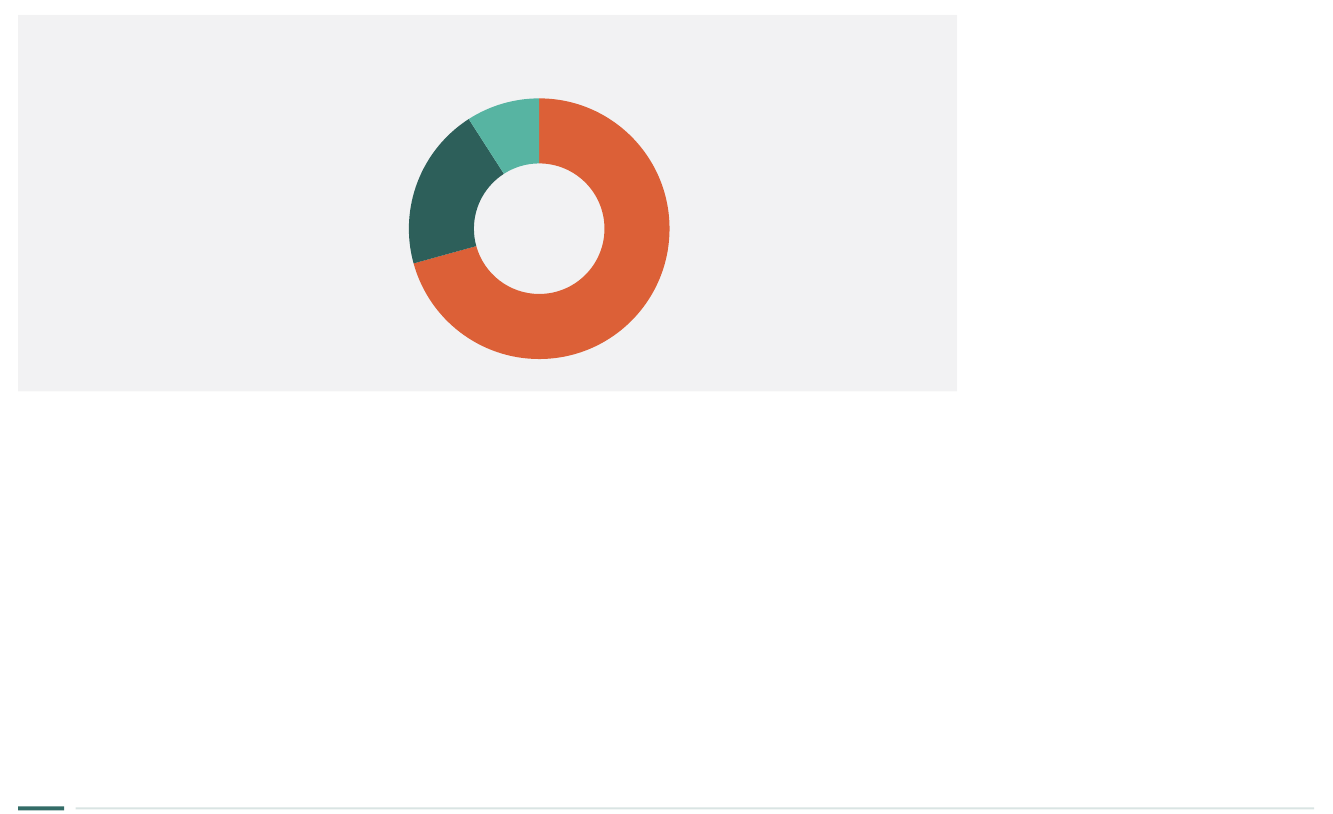

Figure 2

7 in 10 Americans Want Banks to Oer Small Loans to Borrowers

With Poor Credit

Percentage of respondents

Notes: Respondents were asked: “Today, banks generally do not make loans to people with low credit scores. Do you want to see banks begin

to oer small loans of a few hundred dollars to their customers who have low credit scores, or do you not want to see that?” Results are based

on 1,205 interviews.

© 2017 The Pew Charitable Trusts

70

%

Want

to see

23

%

Do not want

to see

7

%

Don’t know/

refused

Want to see banks begin to oer small loans

Banks generally cannot profitably

make loans to people with low

credit scores in the current

regulatory environment. In May

2016, American Banker reported

that at least three large banks

were planning to use the 5 percent

payment option that the CFPB

proposed in its 2015 framework to

oer such customers small loans

repayable in aordable installments

at prices roughly six times lower

than average payday loans, such as

a $400, three-month loan for a

$60 fee.

6

Most Americans would

like to see banks begin oering

these loans.

4

Figure 3

70% of Americans Would View a Bank More Favorably if It Oered

Lower-Cost Small Loans

Percentage of respondents

Notes: Respondents were asked: “Some banks are considering oering a $400, three-month loan with a $60 fee. Payday lenders charge

about $350 for the same loan, while using a credit card would usually cost less than $60. If a bank began oering a $400, three-month loan

for a $60 fee, would your view of that bank be more favorable or less favorable?” Results are based on 1,205 interviews. Numbers do not

total 100 percent due to rounding.

© 2017 The Pew Charitable Trusts

View of banks that oer small loans would be more favorable

Seventy percent of survey

respondents said they would have a

more favorable view of a bank if

it oered a $400, three-month loan

for a $60 fee (as some banks are

planning to do).

7

Banks report that

they would need to use the

5 percent payment option in order

to make these loans available.

70

%

More

favorable

20

%

Less

favorable

9

%

Don’t know/

refused

Hypothetical bank

small loan:

• $400 principal

• 3-month term

• $60 fee

5

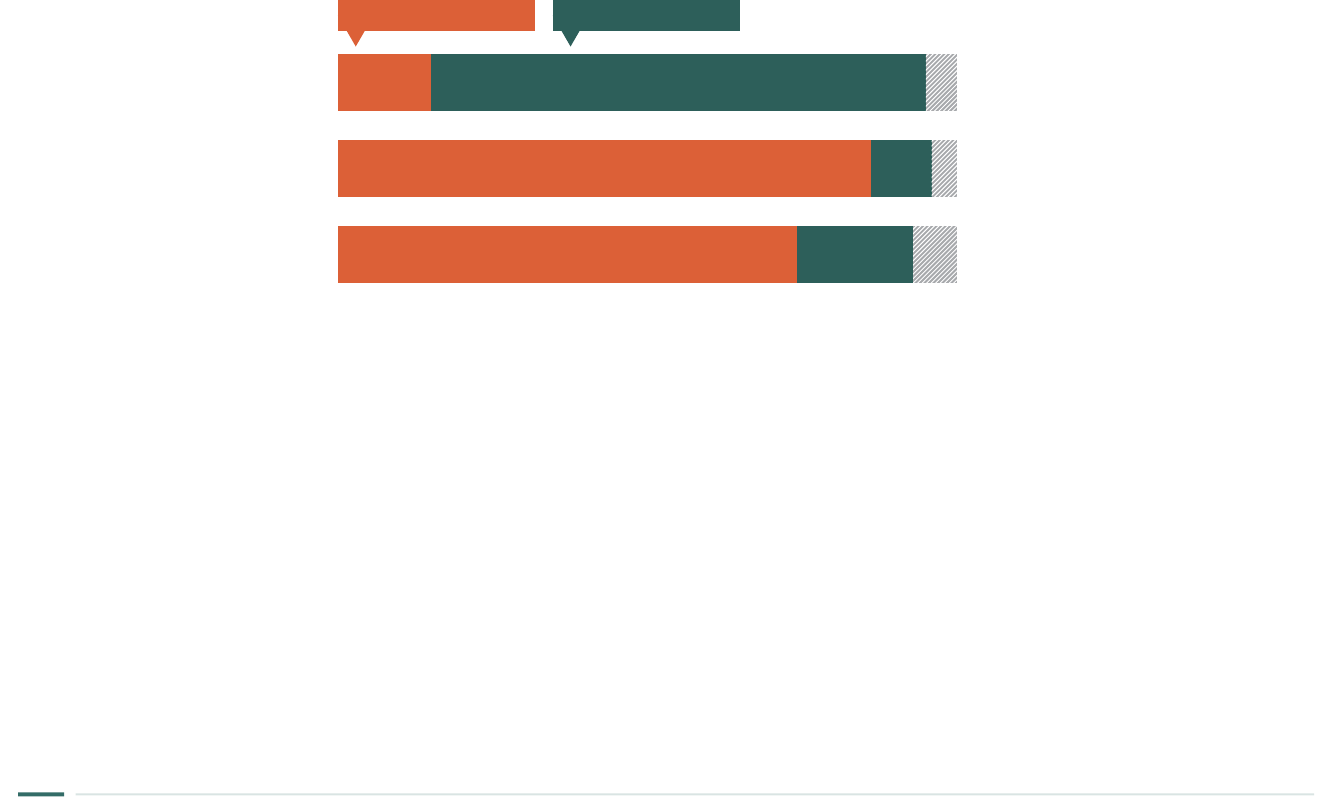

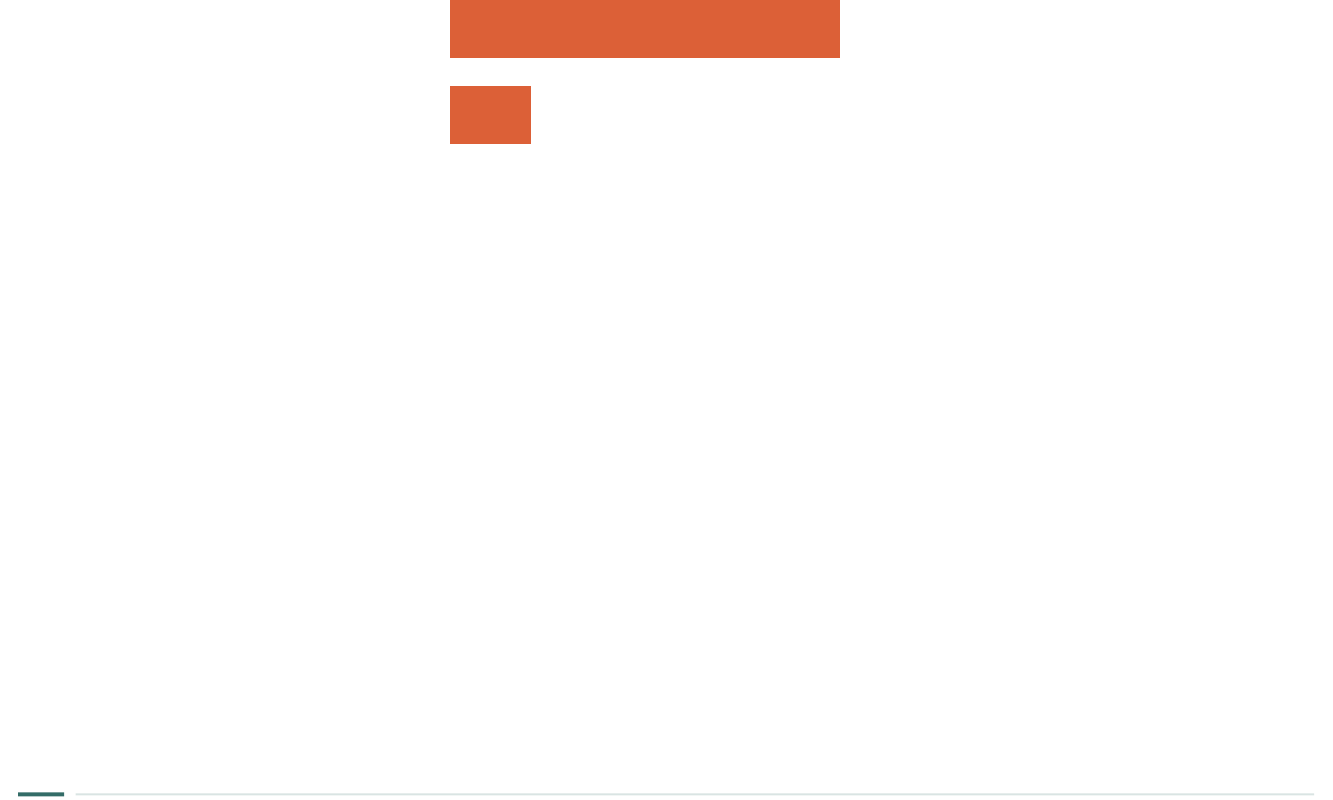

Figure 4

Americans Say Loans That Have More Time to Repay but Still Carry

400% APRs Would Be a Negative Outcome

Percentage of respondents in favor of each possible result

Notes: Respondents were read the following statement: “The government agency that regulates payday lending has proposed some new

regulations. I’d like to get your opinion on some of the possible outcomes of the new regulations. For each, please tell me if you would view

it as mostly a good outcome or mostly a bad outcome. a) If most people who use payday loans got more time to repay them, but the annual

interest rates continued to be around 400 percent; b) If most people who use payday loans could get loans from their banks and credit

unions that cost six times less than payday loans; c) If some payday lenders went out of business, but the remaining lenders charged less for

loans.” Results are based on 1,205 interviews. The order of these statements was randomized in the survey. Numbers do not total 100 percent

because “don’t know” and “refused” responses (indicated in gray) were omitted.

© 2017 The Pew Charitable Trusts

If most people who use payday loans got

more time to repay them, but the annual

interest rates continued to be around 400%

If most people who use payday loans could

get loans from their banks and credit unions

that cost six times less than payday loans

If some payday lenders went out of

business, but the remaining lenders

charged less for loans

15

%

80

%

86

%

10

%

74

%

19

%

Mostly a good outcome Mostly a bad outcome

The most likely outcome of the

CFPB’s June 2016 draft rule would

be to shift the market to longer-

term payday installment loans.

Similar loans today carry interest

rates of around 400 percent,

and prices would not be likely to

decline under the proposal. Most

Americans view that as a bad

outcome. If the CFPB modified

its proposed rule to include the

5 percent payment option it

featured in the 2015 framework,

banks and credit unions would

be likely to oer lower-cost loans,

creating a better alternative

for borrowers. The public

overwhelmingly said that would

be a good result.

6

Figure 5

Americans Care More About Loan Prices Than Origination

Processes

Share of respondents that favors each $400, three-month loan

Notes: Respondents were read the following statement: “Here are two possible outcomes of the proposed regulations for payday lending.

Please tell me which of the two you would view as a better outcome for a $400, three-month loan: If lenders pulled borrowers’ credit reports,

estimated their expenses, and issued that loan for about $350 in fees; If lenders reviewed customers’ checking account histories and issued

that loan for about $60 in fees.” Results are based on 1,205 interviews. The order of these statements was randomized in the survey. Numbers

shown do not total to 100 percent because “don’t know” and “refused” responses were omitted.

© 2017 The Pew Charitable Trusts

If lenders reviewed customers’ checking

account histories and issued that loan for

about $60 in fees

79

%

The CFPB’s proposed rule focuses

on establishing the process that

lenders must use to originate

loans, allowing those willing to

comply with those guidelines to

charge high prices and preventing

lower-cost providers, such as banks

and credit unions, from oering

lower-cost loans at scale. If banks

are permitted to issue loans using

borrowers’ checking account

histories instead of the bureau’s

proposed ability-to-repay process,

their pricing for small-dollar loans

would be roughly six times lower

than that of typical payday lenders.

By a margin of 6 to 1, Americans

prefer the loans that would be

available from banks and credit

unions under the CFPB’s earlier

5 percent payment option to

those that payday lenders would

issue under the proposed ability-

to-repay provision.

If lenders pulled borrowers’ credit reports,

estimated their expenses, and issued that

loan for about $350 in fees

13

%

Loan likely to be issued under the 5% payment option

Loan likely to be issued under the ability-to-repay process

7

Figure 6

Americans Say Payday Installment Loan Charges Are Unfair but

That Planned Bank Small-Loan Prices Are Fair

Share of respondents, by loan type and terms

Notes: Respondents were read the following statement: “Here are some examples of small loans that might be available to people who have

low credit scores. For each, please tell me whether you think the terms seem fair or unfair. (Insert item.) Do you think the terms seem fair or

unfair? a) $500 for a fee of $100 paid back over 4 months, so a person who borrows $500 will pay back $600; b) $500 for a fee of $600

paid back over 4 months, so a person who borrows $500 will pay back $1,100; c) $400 for a fee of $60 paid back over 3 months, so a person

who borrows $400 will pay back $460.” Results are based on 1,205 interviews. The order of these statements was randomized in the survey.

Numbers shown do not total 100 percent because “don’t know” and “refused” responses (indicated in gray) were omitted.

© 2017 The Pew Charitable Trusts

Americans view current payday

installment loans and those likely

to be issued under the CFPB’s

proposed ability-to-repay provision

as unfair, but they say the loans

that banks and credit unions plan to

oer under the 5 percent payment

option would be fair. Banks and

credit unions have said they cannot

take on the paperwork, compliance,

and regulatory risk of the ability-to-

repay process but are interested in

oering small credit at lower prices

with stronger safeguards under the

5 percent option.

Estimated pricing for ability-to-repay payday installment loans

Estimated pricing for 5% payment bank small-dollar loans

UnfairFair

$500 for a fee of $600 paid back

over 4 months

91

%

7

%

$500 for a fee of $100 paid back

over 4 months

37

%

61

%

$400 for a fee of $60 paid back

over 3 months

18

%

80

%

UnfairFair

8

Figure 7

3 in 4 Americans Say It Would Be Good if Banks Oered Small

Loans, Even With Higher APRs Than Credit Cards

Percentage of respondents that agree

Notes: Respondents were read the following statement: “Here are two views regarding small loans that banks might begin oering. Please tell

me which of the two you agree with more. It would be a good thing if banks started oering small loans to their customers who use payday

loans today because the prices would be six times lower than payday loans; It would be a bad thing if banks started oering small loans

to their customers who use payday loans today because the interest rates would be higher than credit cards.” Results are based on 1,205

interviews. The order of these statements was randomized in the survey. Numbers shown do not total 100 percent because “don’t know” and

“refused” responses were omitted.

© 2017 The Pew Charitable Trusts

It would be a good thing if banks started oering small loans

to their customers who use payday loans today because the

prices would be six times lower than payday loans

It would be a bad thing if banks started oering small loans

to their customers who use payday loans today because the

interest rates would be higher than credit cards

77

%

16

%

By a margin of almost 5 to 1,

respondents said it would be a

good thing if banks began oering

small loans at prices six times

lower than those of payday lenders,

even if the rates would be higher

than those for credit cards. All

payday loan borrowers have a

checking account because it is a

loan requirement, so if these loans

became available, they would be

likely to replace a large share of

high-cost loans.

9

Methodology

On behalf of The Pew Charitable Trusts, Social Science Research Solutions conducted a nationally representative

random-digit-dialing (RDD) telephone survey of 1,205 adults Aug. 12–21, 2016. The survey included an

oversample of approximately 200 African-American and Latino respondents, which was weighted to match the

demographic incidence of the RDD sample, producing an overall sample representative of the general population.

The margin of error including the design eect is plus or minus 3.37 percent at the 95 percent confidence level.

A detailed methodology is available at http://ssrs.com/omnibus.

Endnotes

1 Proposed rule, 81 Fed. Reg. 47864 (July 22, 2016), https://www.federalregister.gov/documents/2016/07/22/2016-13490/payday-

vehicle-title-and-certain-high-cost-installment-loans. For a summary of the proposed rule, see The Pew Charitable Trusts, “How the CFPB

Proposal Would Regulate Payday and Other Small Loans: A Summary of the Draft Rule” (2016), http://www.pewtrusts.org/en/research-

and-analysis/analysis/2016/09/07/how-the-cfpb-proposal-would-regulate-payday-and-other-small-loans.

2 The Pew Charitable Trusts, “An Analysis of the Draft Rule: The CFPB’s Proposed Payday Loan Regulations Would Leave Consumers

Vulnerable” (2016), http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/09/07/the-cfpbs-proposed-payday-loan-

regulations-would-leave-consumers-vulnerable.

3 The Pew Charitable Trusts, “How CFPB Rules Can Encourage Banks and Credit Unions to Oer Lower-Cost Small Loans” (2016), http://

www.pewtrusts.org/en/research-and-analysis/analysis/2016/04/05/how-cfpb-rules-can-encourage-banks-and-credit-unions-to-oer-

lower-cost-small-loans.

4 The Pew Charitable Trusts, “Payday Loan Customers Want More Protections, Access to Lower-Cost Credit From Banks” (2017), www.

pewtrusts.org/en/research-and-analysis/issue-briefs/2017/04/payday-loan-customers-want-more-protections-access-to-lower-

cost-credit-from-banks.

5 The Pew Charitable Trusts, Payday Lending in America: Policy Solutions (October 2013), 12–16, http://www.pewtrusts.org/~/media/legacy/

uploadedfiles/pcs_assets/2013/pewpaydaypolicysolutionsoct2013pdf.pdf.

6 Ian McKendry, “Banks’ Secret Plan to Disrupt the Payday Loan Industry,” American Banker, May 6, 2016, http://consumerbankers.com/

cba-media-center/cba-news/banks-secret-plan-disrupt-payday-loan-industry; Consumer Financial Protection Bureau, Small Business

Advisory Review Panel for Potential Rulemakings for Payday, Vehicle Title, and Similar Loans: Outline of Proposals Under Consideration and

Alternatives Considered (March 26, 2015), http://files.consumerfinance.gov/f/201503_cfpb_outline-of-the-proposals-from-small-

business-review-panel.pdf.

7 Ibid.

For further information, please visit:

pewtrusts.org/small-loans

Contact: Esther Berg, communications ocer

Email: [email protected]g

Project website: pewtrusts.org/small-loans

The Pew Charitable Trusts is driven by the power of knowledge to solve today’s most challenging problems. Pew applies a rigorous, analytical

approach to improve public policy, inform the public, and invigorate civic life.